Sustainability Journey

Purpose, Value Creation, and Stakeholder Engagement

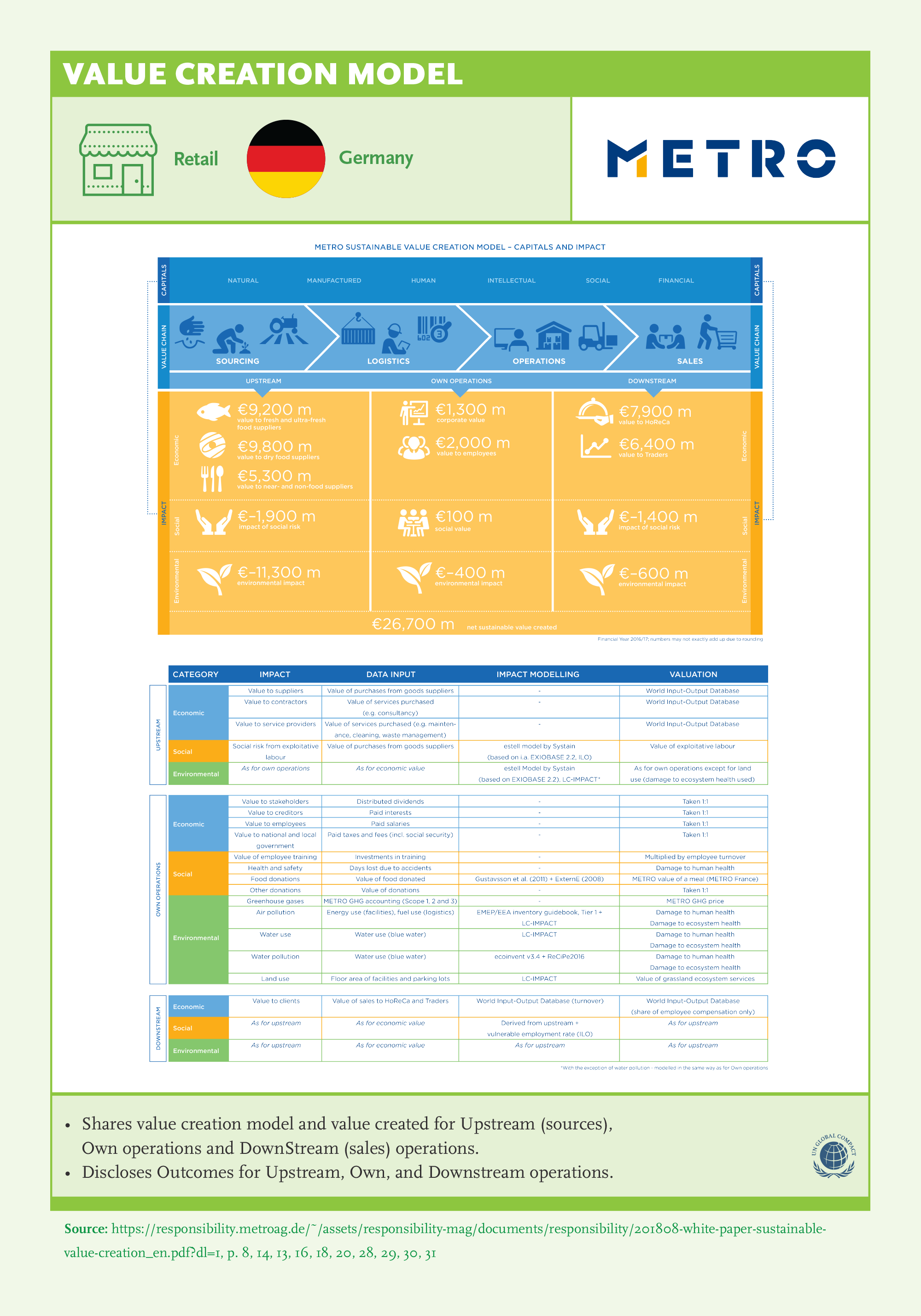

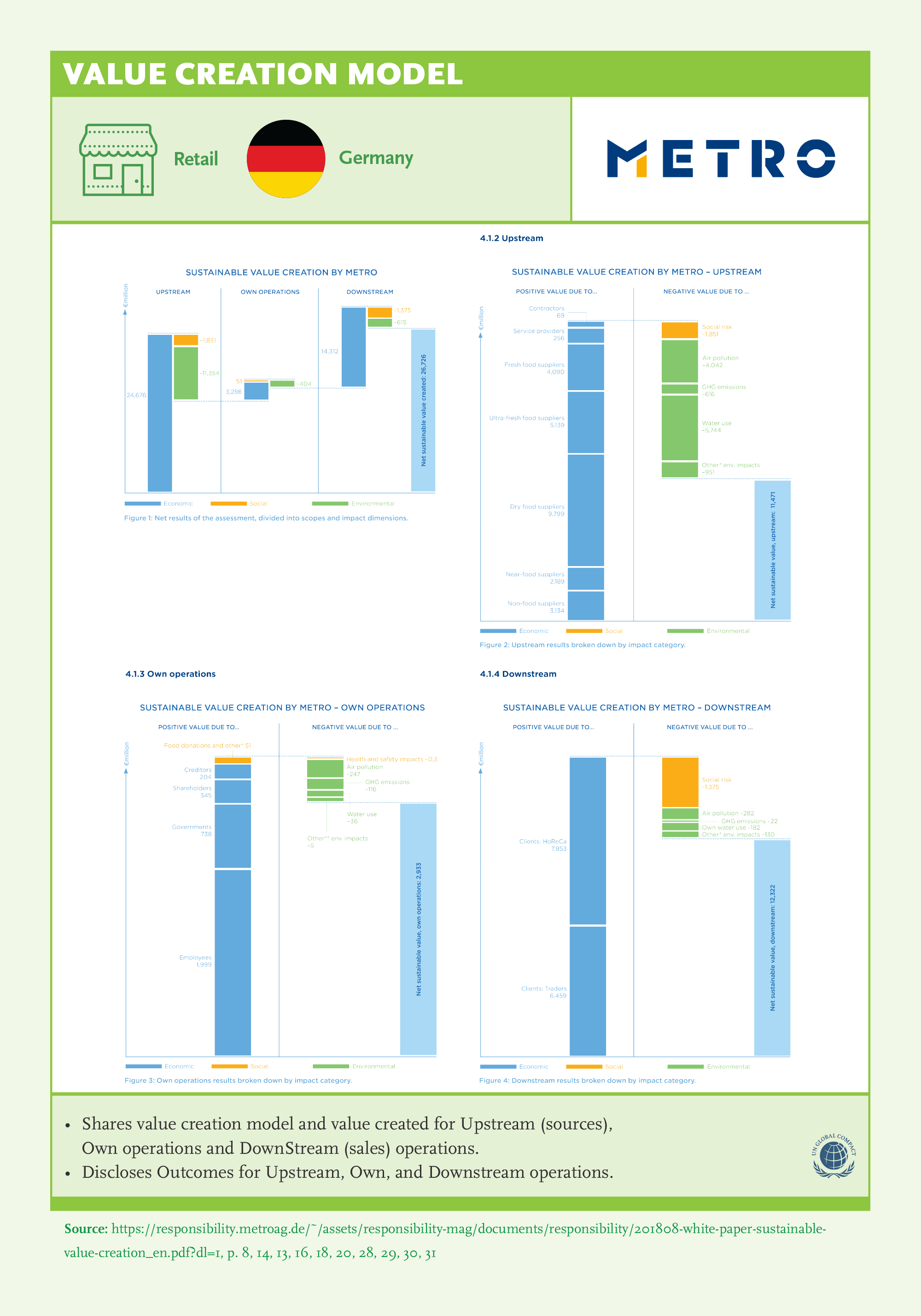

From a stakeholder perspective, articulating a holistic story of how a company creates value for the company, society and the environment; and sharing progress of this journey is a strength. For investors, it offers a proxy for management quality; for customers, it allows responsible choice and enhances brand loyalty; for governments, it highlights where to partner for global action; and for communities; it allows a company to maintain its social license to operate.

Global Sustainability Leaders integrate sustainability into their core value creation model and lead the way in expanding their strategy and management beyond pure financial outcomes, to encompass environmental, social, and governance-related factors that are critical for the future-viability of their organizations.

The success of a company depends on its relationships with the external world, not just customers and investors, but also employees, regulators, politicians, activities, NGOs, technology, and the environment. Good governance covers all stakeholders to achieve balance between risk/reward, short/long-term stakeholder goals, motivate/audit management.

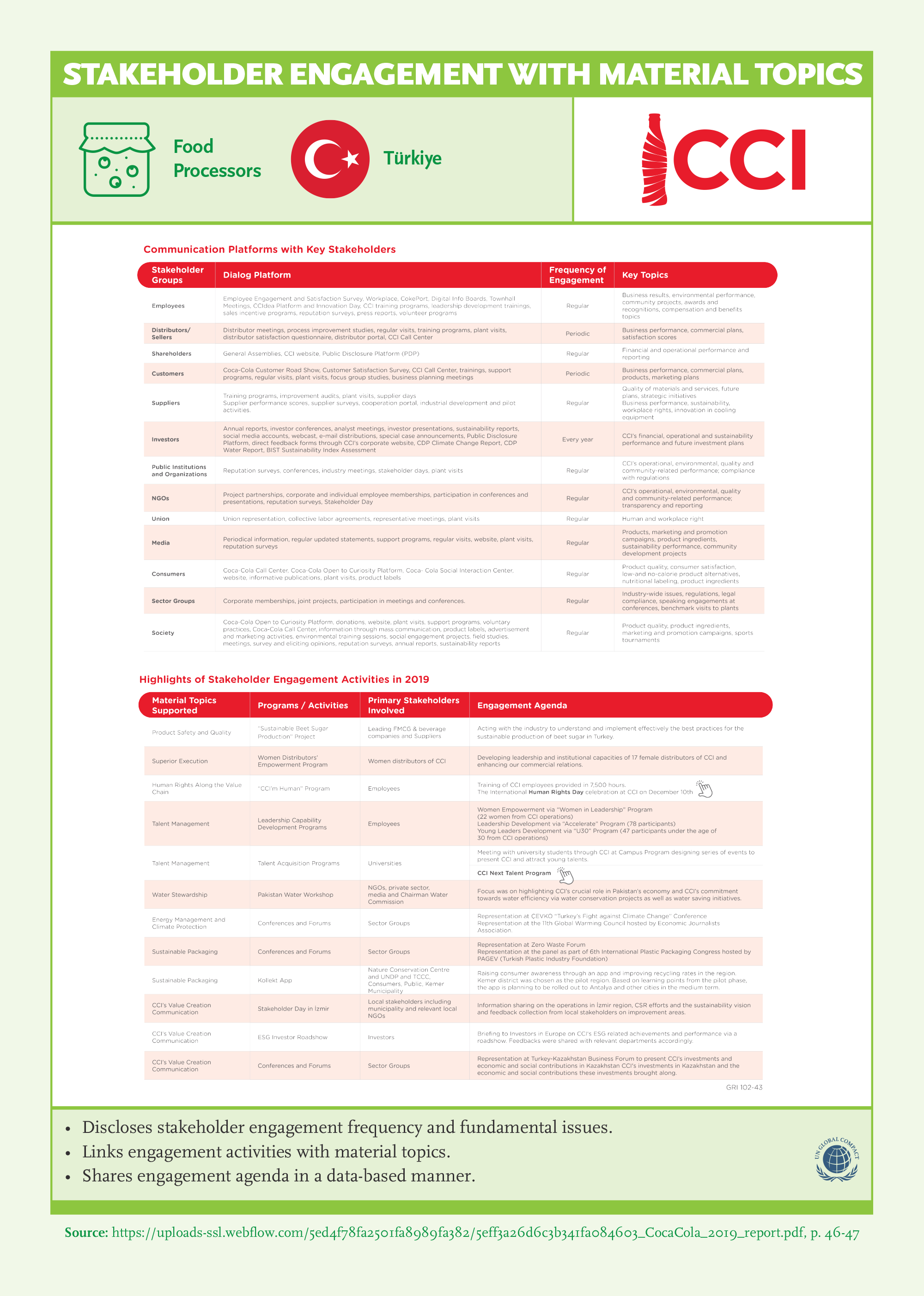

Stakeholder engagement is a critical process that helps companies understand their key environmental and social impacts and identify sustainability risks and opportunities. For this process to be effective, there should be open communication, with an intent on understanding concerns and creating dialogue for establishing relationships based on trust. Best-in-class companies adopt a long-term, comprehensive view of their stakeholders to encompass external stakeholders and clearly articulate how the fulfillment of their purpose benefits society to foster dialogue.

Recommendations

- 1Clearly articulate your purpose and define your sustainability strategy.

- 2Visualize a holistic and sustainable value creation model.

- 3Measure and disclose outcomes for external and internal stakeholders.

- 4Adopt integrated thinking.

- 5Define and engage your stakeholders.

- 6Define governance structure to support stakeholder engagement.

Key Findings

Value Creation

Sustainability issues that may have an impact on intangible areas pose a significant risk for the value of a company. Having the impact of intangibles in mind, companies manage a diverse set of risks that can arise from complex environmental, social and governance related issues and present linkages between them. Some companies go one step further and take on a leadership role to prove that “Doing good is good business” by putting sustainability at the core of their value proposition. These leaders have come to realize that, if sustainability issues are becoming relevant for large populations throughout the world, addressing them properly would be a good business case for satisfying a global need.

- 83% of the GSLs share their business model and visualize the company’s value creation process.

- All South African companies share their value creation model thanks to the <IR> effect.

- All companies in Consumer Goods share a value creation model with the depth of environmental, social, and governance subcategories. While it’s lowest for Türkiye and India (50% and 62%).

Stakeholder Engagement

To gain and retain the trust of stakeholders, the most important issue is to have the right attitude. The yardstick should be the ethic of reciprocity or the golden rule that is prevalent in most religions and philosophers’ writings, which is summarized as “Do unto others as you would have them do unto you.”

- 94% of the companies in our sample share a stakeholder map and 84% share objectives for each stakeholder group.

- Few include Public/Media (47%) and the Environment (38%) in their list of stakeholders. However, Public/Media is the highest among all countries (86%).

- All companies in Consumer Goods, Pharma, Telecommunications, and Utilities share a stakeholder map and almost all of them share objectives.

Best Practice Examples

Supply Chain Sustainability

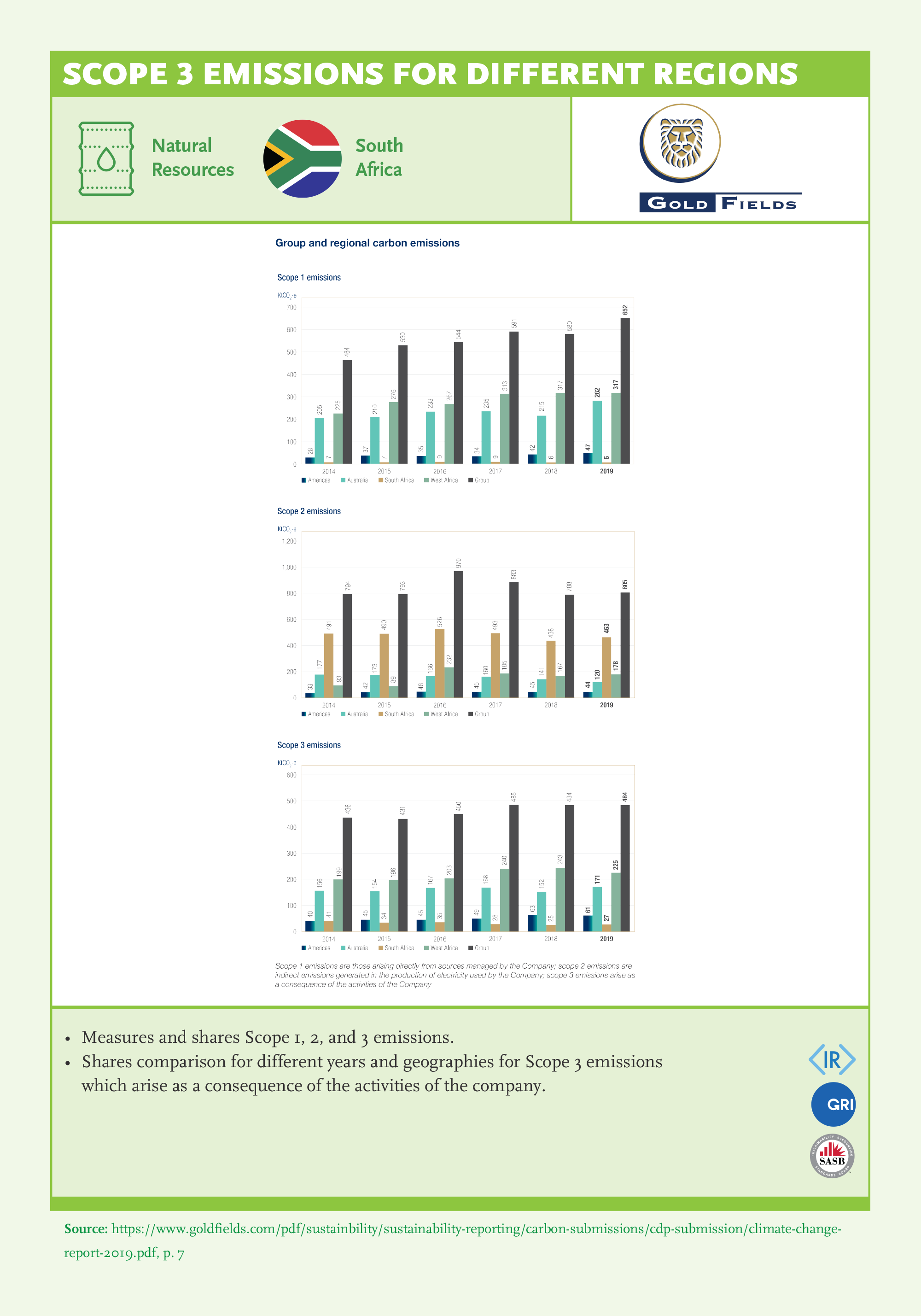

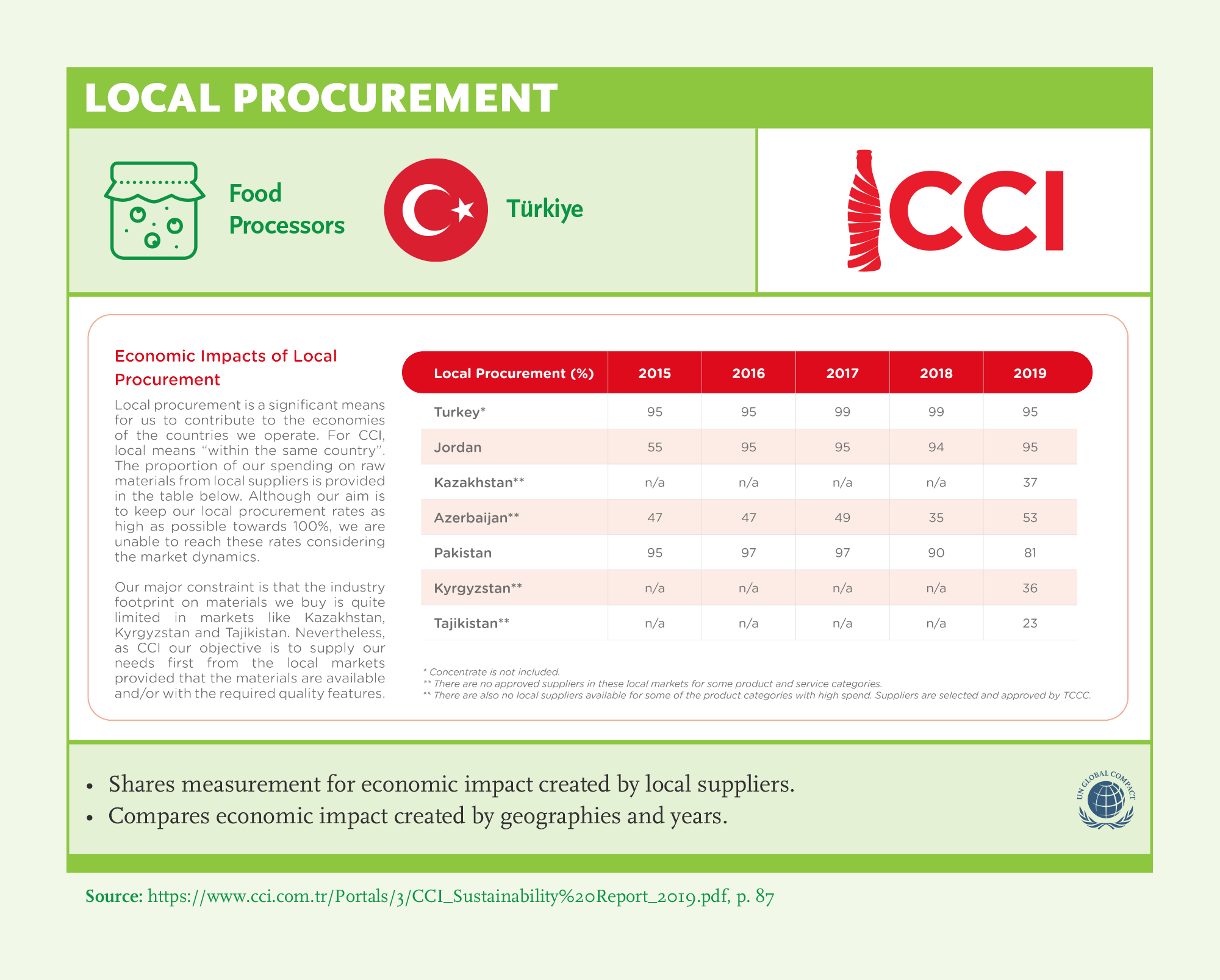

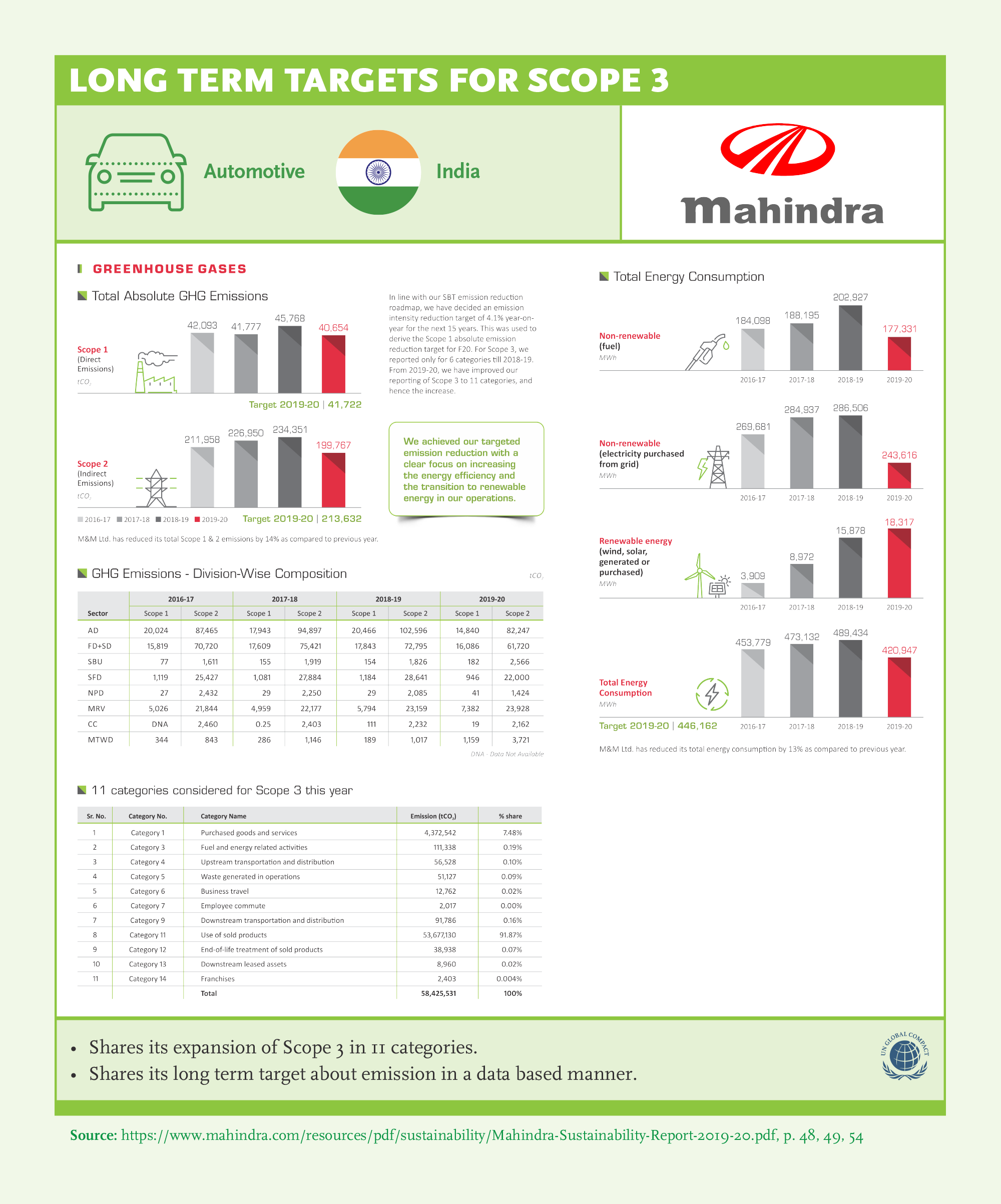

Supply chains are critical links that connect an organization’s inputs to its outputs. Many companies’ greatest sustainability risks and opportunities are in the supply chain. However, sustainability efforts of many companies are limited to measuring the sustainability of their own business operations and they do not extend these efforts to their suppliers and customers.

Leading companies in sustainability accept responsibility throughout their value chains and work with their suppliers to implement sustainability initiatives on a wider playfield. This may involve utilizing their purchasing power to encourage, audit, collaborate with, and provide benchmarking and learning opportunities with their suppliers on key sustainability issues.

Recommendations

- 1Assume responsibility for sustainability across the value chain.

- 2Develop and monitor Code of Conduct for supply chain.

- 3Develop a comprehensive assurance process.

- 4Set KPIs and targets to measure progress against goals and report more details about suppliers to assess and improve performance.

- 5Invest in supply chain developments.

- 6Develop standards for audit and assessing sustainability performance.

Key Findings

Companies recognize supply chain as critical stakeholders. 90% of GSLs defined their supply chain as their stakeholders and 79% of them shared objectives for their supply chain. The percentage of companies that listed the supply chain as a stakeholder increased in SGS 2021 in comparison to SGS 2020 (+7% for the stakeholder list, and +11% for the stakeholder objective).

Supply Chain Assurance

- 94% of the supplier code of conduct covers E, S, G issues.

- All German and South African, all SASB reporting, and all Automotive companies share supplier code of conduct with sub-components of E, S, and G.

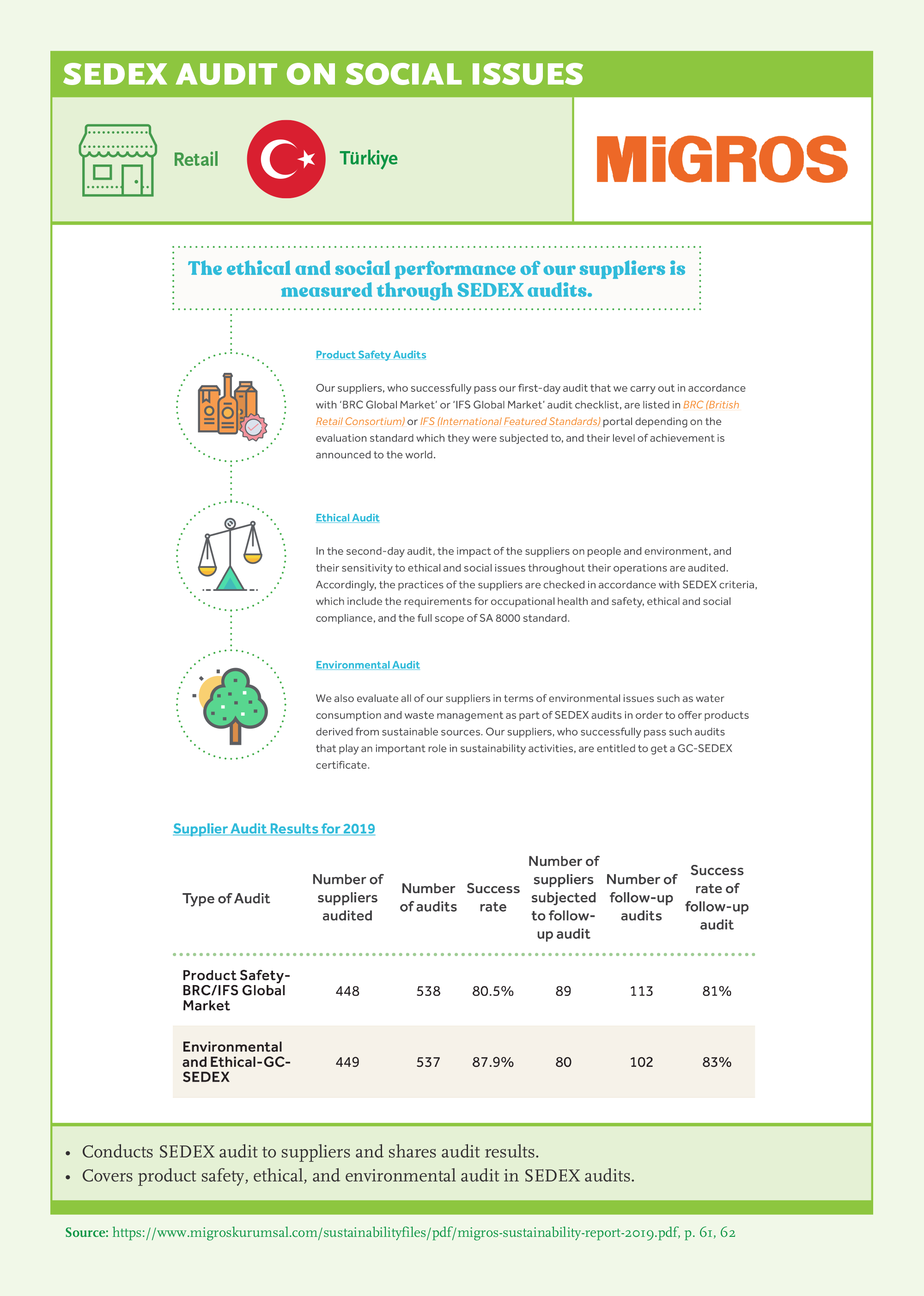

- Supply chain assurance process covers ESG issues (80%, 82%, and 82% respectively). All German companies, all Consumer Goods, and all Food Processors share their supply chain assurance process.

- However, less than half of those that do, share their supply chain assurance results across ESG issues (40%, 43%, and 37% respectively).

- 96% of the companies share assurance processes for supply chain; 85% cover Code of Conduct or Self-Declaration, 84% Internal Audit and 62% third party verification. 63% of the companies rely on certifications. There is an increase in sharing the supply chain assurance process for all assurance methods.

- 69% of the companies share assurance results for supply chain; 58% share compliance results, 24% share certification, and 18% share results for third party verification.

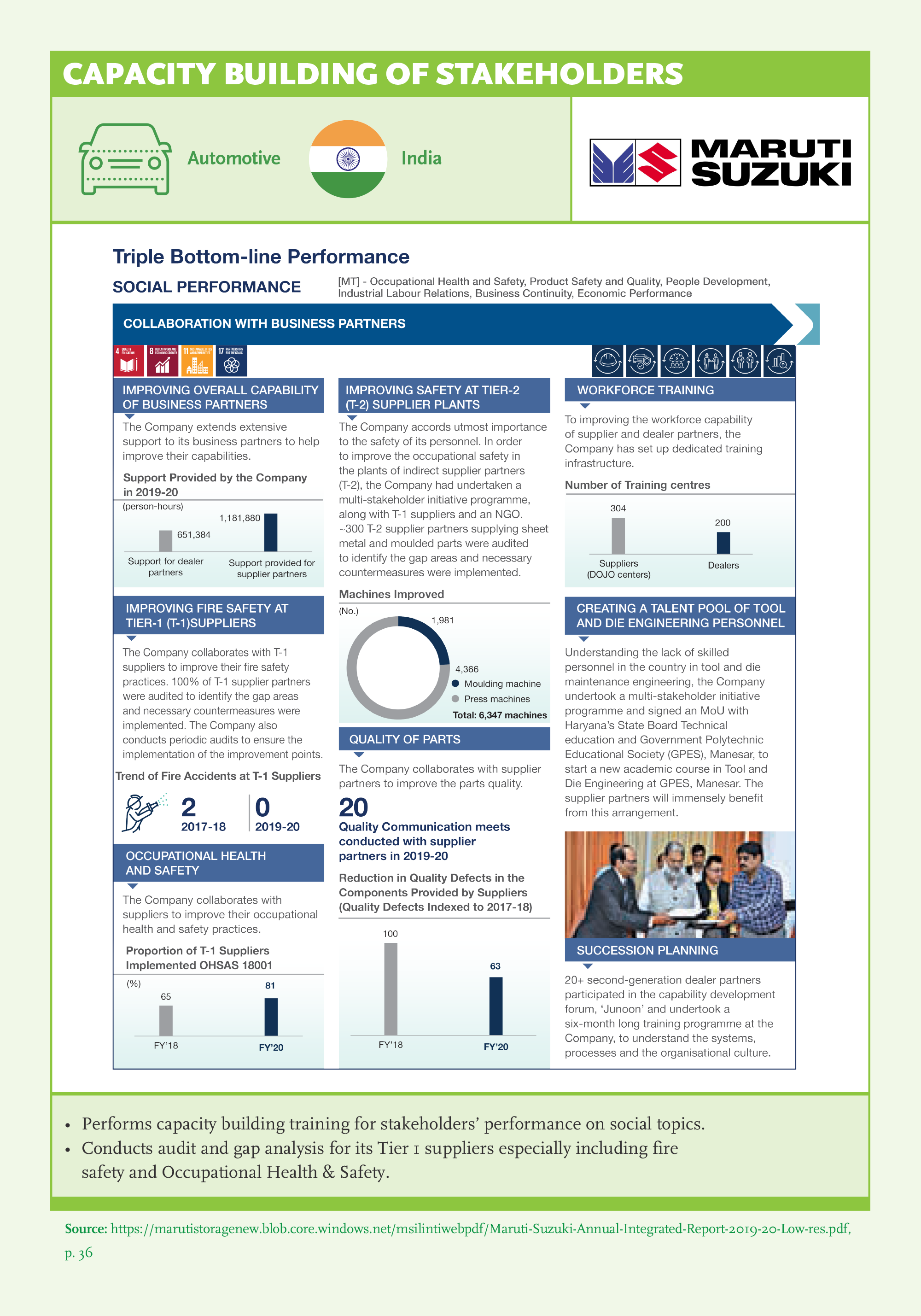

- 60% invest in capability building for their supply chain, 53% include remedial action for high-risk suppliers, and 44% mention a channel for reporting violations and grievances.

- Compliance with the Code of Conduct or Self Declaration is used by Automotive, Consumer Goods, Food Processors, Natural Resources, Pharma, Retail, and Utilities (more than 80%).

- Certification process for assurance selected by Consumer Goods and Food Processors.

- Third party verification is used mostly by Chemicals.

- Machine & Equipment and Telecommunications are lagging in all supply chain verification processes.

- Pharma companies outperform only in Compliance with Code of Conduct or Self Declaration.

Audit for Sustainability

- Almost all of the companies conduct internal audit for sustainability and they report to the Board (more than 98%). Internal audit is highest for governance issues, whereas lowest for environmental issues.

- Independent audit for sustainability issues is conducted less often than internal audit. 83% of the companies conduct independent audit covering sustainability issues; mostly focusing on environmental issues (75%).

- Only 60% of the companies perform independent audit for their supply chain, with an increase of 13% in comparison to SGS 2020.

- Sharing the results of a third party audit for the supply chain is as low as 18%. Room for improvement is obvious.

Best Practice Examples

Continuous Learning and Development

Integrating sustainability into the organization’s processes and culture requires a continuous learning climate. Lessons learned should be utilized to improve decision-making processes, skill gaps and required mindset changes need to be addressed through training, sustainability practices need to be integrated into the company’s culture. To assess whether the learning culture is sustained throughout the cycle, we seek evidence of any learning or improvement in performance of sustainability efforts.

Training programs should include sustainability (e.g. compliance, unconscious bias) to address the skill and mindset gaps. Developments can include organizational development –incorporating lessons learned into orientation, education, promotion, and compensation processes– to address organizational processes, changes in incentive mechanisms, reporting allocated resources for improvements, improving stakeholder engagement, or mobilizing collective action in areas where the company’s resources would fall short –especially with respect to the SDGs.

Recommendations

- 1Adopt a learning mindset, sustainability is a continuous journey.

- 2Train your workforce in sustainability.

- 3Report results by geography; cover management, and the employees.

- 4Think of building capacity in your ecosystem.

- 5Establish a learning loop for continuous improvement by disclosing remedial action to address gaps.

- 6Provide board leadership and oversight for deployment.

- 7Incorporate lessons learned into the organization’s processes and culture.

Key Findings

Gap analysis and Resource Allocation for Development

Achieving sustainability goals require mobilizing the workforce and ensuring a continuous learning mindset is embedded in the company’s processes. A successful deployment program requires establishing a framework for effective communication and continuous learning for the employees as well as members of the supply chain, and also clear guidelines and remedies for those who fail to follow the corporation’s sustainability standards. The organization must incorporate sustainability issues into hiring and remuneration policies as well as supplier identification processes and make sure that the management information systems provide adequate, appropriate, and verifiable data on key sustainability priorities.

Awareness of the responsibility for sustainability can not be delegated to one segment of the organization. It must be firmly established at the top, and inculcated throughout all levels and aspects of the company. And then, it needs to be practiced as an integral part of doing business; internal control systems, external reviews, and stakeholder engagement processes. Compliance requirements should all be utilized for continuous learning opportunities, rather than as tick-the-box compliance requirements.

- 87% of the GSLs take action based on learnings, 91% share resources allocated for development, but only 47% report gap analysis on sustainability issues; even lower for governance (11%) and environmental (7%) topics, highest for social issues (43%).

- Gap analysis is mostly done for employees; less than 10% of the companies disclose gap analysis by geography, for the supply chain, and communities.

- Very low results for disclosure by geography; less than a quarter of the GSLs disclose results for actions and resources allocated, only 3% disclose gap analysis.

- Gap analysis is highest in UK and Automotive companies, whereas it is lowest for US and Chemical companies.

- More than half of the <IR> and UNGC companies perform gap analysis. Adopting an initiative makes a difference in performing gap analysis.

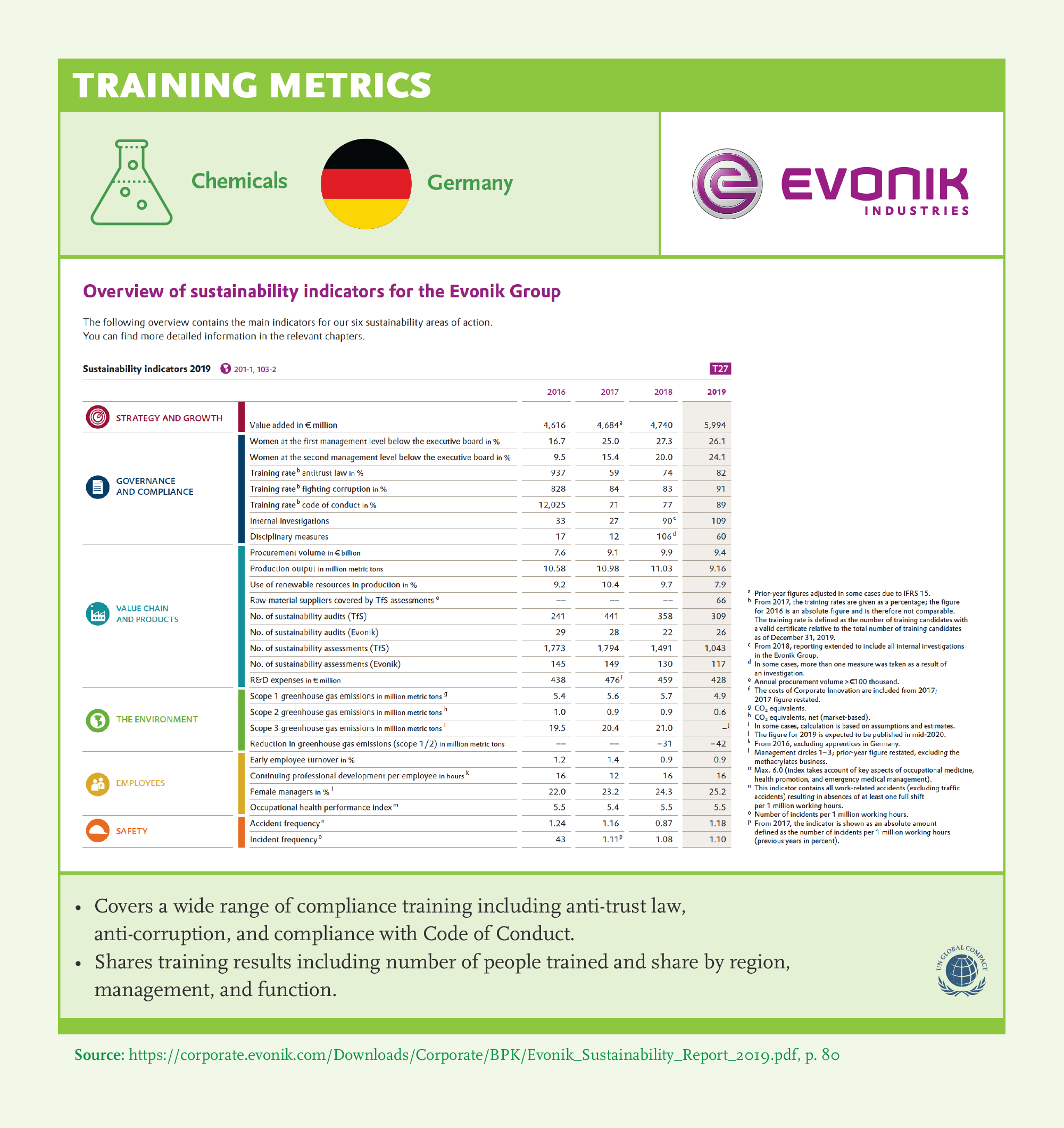

Training

Managing sustainability calls for corporations to implement their sustainability agenda through a continuous learning process is a complex task. Such a process needs to involve all the stakeholders to integrate sustainability into the culture of an organization. Only when all stakeholders are acting together in an ecosystem, goals such as human rights, non-discrimination, environmental or product stewardship can be truly achieved.

For example, it is not sufficient to have the correct way of sourcing, unless you make sure your suppliers adopt the same standards of responsibility. This might require expanding training programs across the supply chain and/or customers. Therefore, we also evaluate whether coverage of the improvement initiatives encompass all relevant stakeholders including all levels of the organization, all geographies in the company’s jurisdiction, supply chain, and communities.

- 95% of the companies report that they conduct training on social sustainability issues, while 78% report governance (compliance) and only 52% report environmental training. The majority of the social sustainability training focuses on employees; 88% on talent development and employee wellbeing, and 82% on occupational health & safety training.

- There is room for improvement in reporting training metrics and outcomes. We find that 88% of the companies report metrics for social training, while 57% report governance training results, and only 40% report environmental training results.

- Social training results are shared mostly for employees (84%), but also for communities (47%), and management (32%).

- There is significant room for improvement in reporting training results for communities and the supply chain, especially in terms of governance training. To establish trust between the institutions in their ecosystems, companies must take responsibility to improve transparency and governance in the environments in which they operate.

- There are very limited results sharing for environmental sustainability training for all stakeholders (less than 25%).

- Almost all the companies report social sustainability training (95%); highest for employee wellbeing and talent development (88%), followed by health & safety (82%). There is room for improvement in diversity & inclusion training (53%).

- Only 52% of GSLs report environmental sustainability training; highest for responsible sourcing (29%), below 25% for managing natural resource use and efficiency. Companies must invest in training their workforce, management, and supply chain on climate change, energy efficiency, waste & packaging, and water stewardship.

- 78% of the companies report compliance training, only 32% include compliance training for supply chain.

Best Practice Examples